indiana inheritance tax exemptions

Indiana Inheritance and Gift Tax. Last year the Indiana legislature enacted a plan to phase out Indianas Inheritance Tax by the end of year 2021.

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

For individuals dying after December 31 2012.

. In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate. Code 6-41-3et seq. Miscellaneous taxes and exemptions represents a specific individual material embodiment of a distinct intellectual or artistic creation found in Indiana State Library.

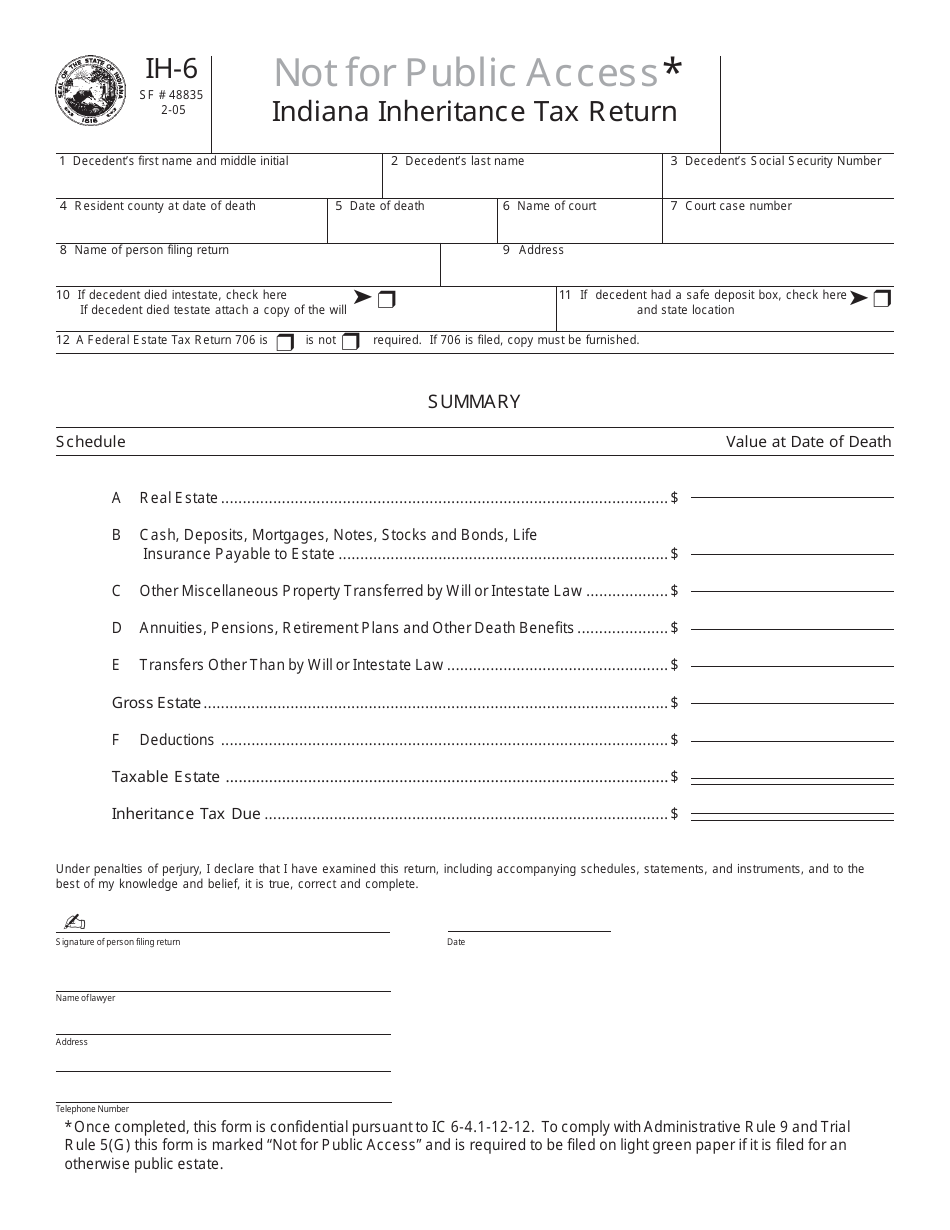

Indiana Inheritance Tax Exemptions and Rates. In addition no Consents to Transfer Form IH-14. Ad Access Tax Forms.

Each heir or beneficiary of a decedents estate is divided into three classes. 2012 Indiana Code TITLE 6. Inheritance tax was repealed for individuals dying after December 31 2012.

No tax has to be paid. INHERITANCE TAX EXEMPTIONS AND DEDUCTIONS IC 6-41-3 Chapter 3. Inheritance tax exemptions and deductions download as pdf.

However that phase out was accelerated dramatically. All Major Categories Covered. The inheritance tax rates are Class A Net Taxable Value Of Property Interests Transferred.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. In 2021 the credit will be 90 and the tax phases out completely after December 31 2021. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

205 2013 Indianas inheritance tax was repealed. There is no inheritance tax in Indiana either. No inheritance tax returns Form IH-6 for Indiana.

Transfers to a spouse are completely exempt from Indiana inheritance tax IC6-41-3-7. Indiana has a three class inheritance tax system and the exemptions and tax rates. Complete Edit or Print Tax Forms Instantly.

Indiana used to impose an inheritance tax. In 2021 the credit will be 90 and the tax phases out completely. How much money can you inherit without paying inheritance tax.

The amount of each beneficiarys exemption is determined by the relationship of that beneficiary to the decedent. Repeal of Inheritance Tax PL. 2015 indiana code title 6.

Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566. Select Popular Legal Forms Packages of Any Category. However other states inheritance laws may apply to you if someone living in a state with an.

Each class is entitled to. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. You may also contact DOR via email call us at 317-232-2154 Monday through Friday 8 am430 pm ET or via our mailing.

Indiana Inheritance Tax is imposed on the transfer of property from an Indiana decedent to a beneficiary. DEATH TAXES CHAPTER 3. For deaths occurring in 2013.

This tax ended on December 31 2012. Inheritance Tax Exemptions and. The item Inheritance tax.

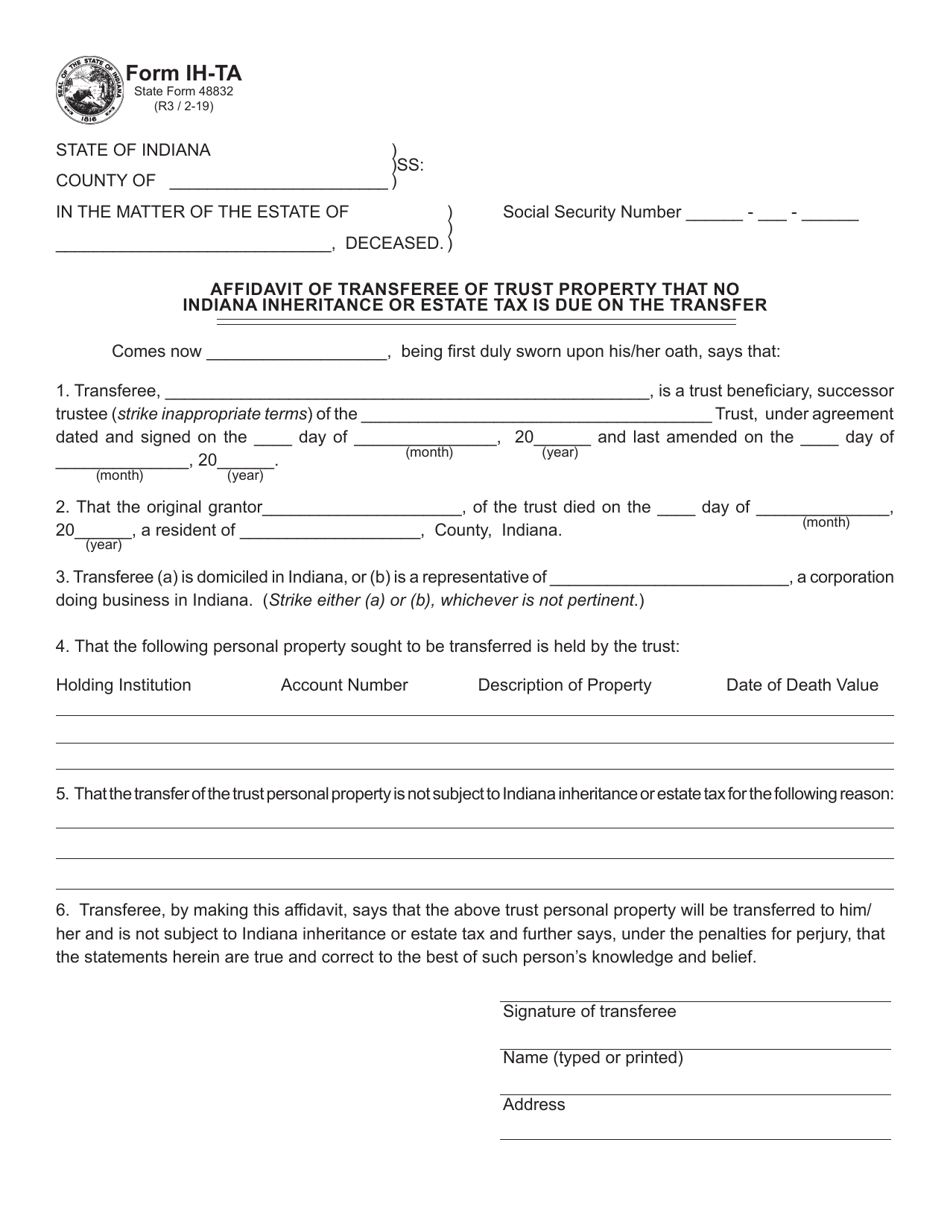

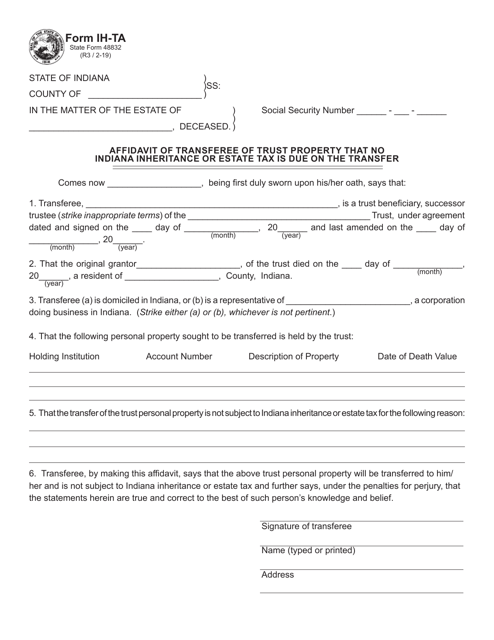

For more information check our list of inheritance tax forms. Ie the total value of interest minus the applicable exemption by the appropriate tax rate. The affidavit may be used.

No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed. Death taxes chapter 3. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for.

It may be used to state that no inheritance tax is due as a result of Decedents death after application of the exemptions provided by Ind.

State Estate And Inheritance Taxes Itep

States You Shouldn T Be Caught Dead In Wsj

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Indiana Estate Tax Everything You Need To Know Smartasset

Another State Death Tax Kicks The Bucket Will More Fall

Indiana Estate Tax Everything You Need To Know Smartasset

Form Ih 6 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return Indiana Templateroller

Form Ih Ta State Form 48832 Download Fillable Pdf Or Fill Online Affidavit Of Transferee Of Trust Property That No Indiana Inheritance Or Estate Tax Is Due On The Transfer Indiana Templateroller

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Should Indiana Phase Out Inheritance Tax Indianapolis Business Journal

Form Ih Ta State Form 48832 Download Fillable Pdf Or Fill Online Affidavit Of Transferee Of Trust Property That No Indiana Inheritance Or Estate Tax Is Due On The Transfer Indiana Templateroller

States With No Estate Tax Or Inheritance Tax Plan Where You Die

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Form Ih 6 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return Indiana Templateroller

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

Indiana Estate Tax Everything You Need To Know Smartasset

Should Indiana Phase Out Inheritance Tax Indianapolis Business Journal